OUR SERVICES

Our clearing, settlement and custody solutions focus on the safe and efficient management of our clients’ assets. We offer a range of flexible services to manage all securities-related activities from pre-trade to post-trade, including full execution, clearing and settlement capabilities, as well as other underlying asset services that clients may require.

In addition, we closely monitor and shape market trends (e.g. regulations, new technologies) at both the global and local levels. Thanks to our rigorous monitoring, our customers can rely on timely, accurate updates on global market practices.

By appointing us as a clearing, settlement agent and custodian, you have access to a full range of solutions to meet your needs. Whether it’s core or value-added services, we have a full suite of solutions that are fully integrated with our hosting offerings.

To learn more about our services, please contact us by clicking the button below.

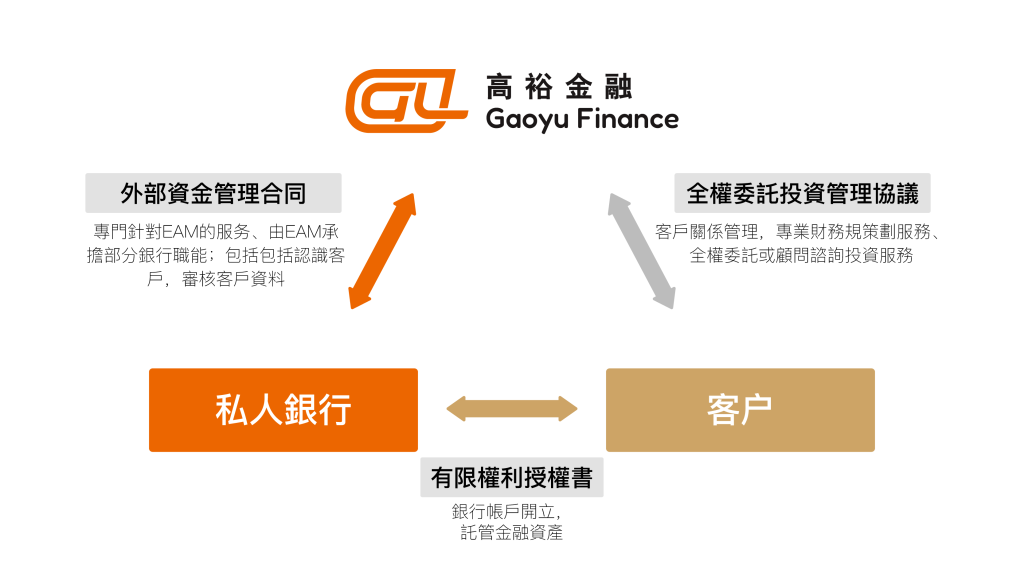

Gao Yue Asset Management’s independent investment managers partner with a number of international private banks and a client-first management approach.

External Asset Managers (EAMs) are the main form of supplementing the private banking business. Compared with traditional private banks, EAM is independent of the banking system and is customer-centric, providing more personalized, flexible and independent investment advice and wealth management solutions. As a third-party platform, EAM forms a tripartite contractual relationship with customers and private banks, and customers fully entrust EAM to manage the assets of their private banks, and the private banks act as the custodian of assets to ensure the safety of customer assets.

Customer-centric

The starting point and goal of the EAM platform are the needs and interests of customers. It is not driven by the profit of product sales or transaction commissions, and is not limited to one bank, and provides customers with the most suitable solutions from a neutral and objective perspective by integrating the superior products and services of different banks.

Customers also only need to use EAM as a unified service window to communicate with different private banks and investment banks, and truly realize the diversified management of assets across regions and banks.

Funds security and privacy protection

EAMs operate under a regulatory framework and do not hold any client assets, which are always held in private bank accounts of the client’s choice, and the security of funds is fully guaranteed. Under the EAM model, the KYC process of banks to customers is relatively simple, and customers do not need to face different RMs of multiple banks at the same time, which is conducive to protecting their privacy.

Efficient communication and cost savings

EAM covers multiple banks at the same time, receives comprehensive information, is familiar with industry practices, can greatly save customers in the traditional private banking mode of communication and trade-offs one by one time and energy, at the same time, EAM has stronger bargaining power than individual customers, can minimize all external fees paid by customers.

Independent and professional management mode

Evaluate the customer’s risk criteria and investment objectives, flexibly select the best institution according to the customer’s needs and circumstances, diversify the custody of assets, financing loans, fund investment, etc., provide customers with independent investment advice and financial consulting services, assist customers to understand and participate in the latest development of various products and services, timely provide early warning to customers, and also assist customers in making trading decisions.

To learn more about our services, please contact us by clicking the button below.

Family trust can effectively help the family to isolate the trust property from the settlor’s other assets, so as to play a role in asset protection, and can achieve the functions of wealth inheritance and tax deferral.

Yu Ying Trust, a subsidiary of Gao Yue Financial Group, has been granted a trust license by the Hong Kong Companies Registry (Ref. No. TC009214) Able to provide customers with overseas family trust structuring and asset custody services.

A Family Trust is when a person entrusts the ownership of his property to a Trustee, who manages the property in the trust in accordance with the Trust Deed, and transfers the assets to the designated beneficiaries under specified circumstances.

Family trust is an effective financial management tool, through the signing of standard contracts and tailor-made Memorandum of Wishes (MoW), you can customize financial products for customers to achieve multiple purposes such as investment and financial management, wealth management, property inheritance, pension planning and so on. The initial trust property of a family trust can be:

– Cash

–

Shares of listed companies

– Bonds

–

Equity in private companies

–

Property properties

Family Trusts (Family Trust).

–

Avoid the inconvenience of court legalization, expensive costs and long-term freezing of the estate, and distribute the estate quickly.

–

There is secrecy, and estate data does not become a public record like a will

–

Ability to control to the greatest extent

–

In the event that the grantor loses the legal capacity for physical and volitional judgment, it is not necessary to appoint a manager through the certification court

–

It is not easy to refute arguments and promote family stability and harmony

To learn more about our services, please contact us by clicking the button below.

Family offices play an important role in managing large amounts of wealth, facilitating intra-family communication and wealth inheritance. The core of a family office is wealth investment management, and a well-established family office will provide customers with customized services through the establishment of a professional service team, including financial planning, family strategy, family governance and professional consulting.

In addition, family offices aim for the long-term development of family assets and the inheritance of wealth. When a family’s assets have developed to a certain stage, the issue of inheritance is no longer simple, and the family office can help family members to eliminate differences and reduce disputes in the process of material and spiritual inheritance.

We understand the wishes of our clients and assist them in planning their family’s business and wealth for an effective and systematic legacy to future generations. Our professional team will also provide professional advice on matters such as wills, trusts, tax issues and the formation of charitable foundations.

–

Understand the wishes and aspirations of the founders, as well as the interests and concerns of family members

–

Develop a business succession strategy to protect the value of the business, balance the interests and concerns of all family members, and help future generations maintain good relationships

– Prepare resources for enterprise inheritance, improve the existing management system and operation mode, and find suitable talents

– In the succession process, provide professional advice on relevant tax issues or shareholder concerns to find a better approach

– Provide professional advice on wealth distribution and trust management

To learn more about our services, please contact us by clicking the button below.

In order to enable customers to grasp the opportunity to make profits in the down-to-market market, Finrich provides Hong Kong stock borrowing and short selling services (excluding China A shares traded through Stock Connect), and the securities must be Hong Kong-listed securities in the list of designated securities available for short selling on the HKEX website.

If the customer expects the market or part of the stock price to fall, he only needs to call our company to make a borrowing request, if the market provides borrowing of the stock, the customer’s margin account also has sufficient opening margin, and accept the corresponding borrowing conditions, then the borrowing process will be successfully completed, and then you can call to sell the stock at any time.

Clients can buy back the shares at a low price and return them, earning the difference in price and making a profit. By simply borrowing and shorting through our company’s simple borrowing and short selling process, you can grasp the opportunity to make profits in the low market.

To learn more about our services, please contact us by clicking the button below.

Structured products are a combination of several financial instruments. Its investment returns are linked to the performance of the underlying asset (e.g. a single stock, basket of stocks, options, indices, commodities, bonds, foreign currencies or real estate, etc.). Structured products can be classified as generic or hybrid, and the returns can be linked to any asset portfolio to suit the investor’s investment objective and risk level.

Structured products are different from traditional investment vehicles. Structured products are complex in nature and have higher relative risks and price fluctuations than traditional investment vehicles. Structured products may provide investors with an opportunity to earn higher returns than traditional investment vehicles, subject to market or other factors favouring the underlying structured products.

We offer a wide range of structured products, such as Equity Linked Notes, Equity Linked Investments, Accumulator Contracts, Accumulator Contracts, Partially Principal Protected Notes, Fund-Linked Notes and Currency Linked Notes, as well as U.S. stocks, Hong Kong stocks, A-shares and global indices as linked assets to help you achieve different investment objectives.

To learn more about our services, please contact us by clicking the button below.

With an experienced team of asset management consultants and expert strategists, Gao Yue Asset Management is always on top of global markets to capture market opportunities and discover the best investments.

Customized investment solutions

Through a series of goal-based investment solutions, we provide clients with highly customized and personalized services to meet their individual needs and achieve a variety of investment objectives.

In today’s market conditions, clients are increasingly focused on achieving a specific objective, and therefore require an investment philosophy tailored to that specific objective. Leveraging its expertise in the field of bespoke investment solutions, Gao Yue Asset Management seeks innovative, purpose-based investments based on the best fit for the specific needs of our clients and the right level of interaction.

This approach is based on regular dialogue around the strategic objectives of the portfolio, the company’s beliefs and the needs of our clients at different times, based on the principles of openness and transparency.

Gao Yue Asset Management has curated a series of customized mandate portfolios to achieve multiple objectives for clients, from wealth preservation to capital growth, while keeping risk management in mind during the asset allocation process.

API transactions (short for Application Programming Interface) allow customers to connect two applications. For example, a client’s high-margin trading account and a client’s customised platform. Trading with API gives clients direct access to our system, which in turn gives them faster order execution and more options for trade control.

Our API provides clients with a convenient way to access real-time market data, historical levels, and trade execution through their Premium account. In other words, clients don’t need to manually search for data and prices in the order books and dark pools of different exchanges. Instead, customers can receive relevant information directly, ensuring speed and efficiency in transactions.

Trading with APIs is popular among hedge funds, registered trading firms, and retail traders, as it gives clients access to more advanced programs.

To learn more about our services, please contact us by clicking the button below.